The United States relies heavily on China for supplies of raw materials such as rare earths. This is set to change – through domestic production and diversified supply chains, but also through new legislation.

Critical raw materials such as rare earths and strategic metals are indispensable to most modern technologies. The rare earth metals neodymium and praseodymium, for example, are needed for electric cars, wind turbines, smartphones and laptops, but also for military technology. The U.S. is heavily dependent on China, the world market leader, for supplies of these raw materials: According to the US Geological Survey (PDF), 78 percent of all rare earth imports between 2017 and 2020 came from the People’s Republic. In light of ongoing geopolitical tensions, the U.S. is seeking to develop new sources of supply. The entire value chain, from mining to processing to recycling, is to be stabilized.

“America is blessed with an abundance of natural resources that can help us address our reliance on foreign supply chains for critical minerals”, says U.S. Senator Joe Manchin (Democrats). Along with Joni Ernst (Republican), who like him is a member of the Senate Armed Services Committee, Manchin introduced the bipartisan Homeland Acceleration of Recovering Deposits and Renewing Onshore Critical Keystones (HARD ROCK) Act. The goal is to strengthen the National Defense Stockpile (NDS), a stockpile of strategic materials held by the Department of Defense. It serves to provide defense contractors and key civilian producers with an immediate supply of needed raw materials in times of war or national emergency. Due to heavy reliance on imports for many critical minerals, the U.S. is not adequately equipped to do so, Manchin’s memo states.

The HARD ROCK Act is the latest in a series of commodity security bills and measures. In April, the Obtaining National and Secure Homeland Operations for Rare Earth (ONSHORE) Manufacturing Act was introduced to promote rare earth production in the United States. There are also plans to stop using Chinese rare earth metals in U.S. Department of Defense weapons systems starting in 2026 (we reported). In view of faltering global supply chains, President Joe Biden also reactivated the Defense Production Act, a law from the Cold War era, on several occasions. It allows companies to be obligated to accept and prioritize orders deemed necessary for national defense. In March, the Defense Production Act was used to secure minerals for e-car production, such as lithium and cobalt. Currently, Biden wants to increase domestic production of components for solar panels and other green energy technologies through this means. China also dominates the global market in the production of photovoltaic modules. Biden’s administration also recently approved funding, for mapping deposits of critical raw materials in numerous U.S. states.

Rare earths: Soon to be Made in USA

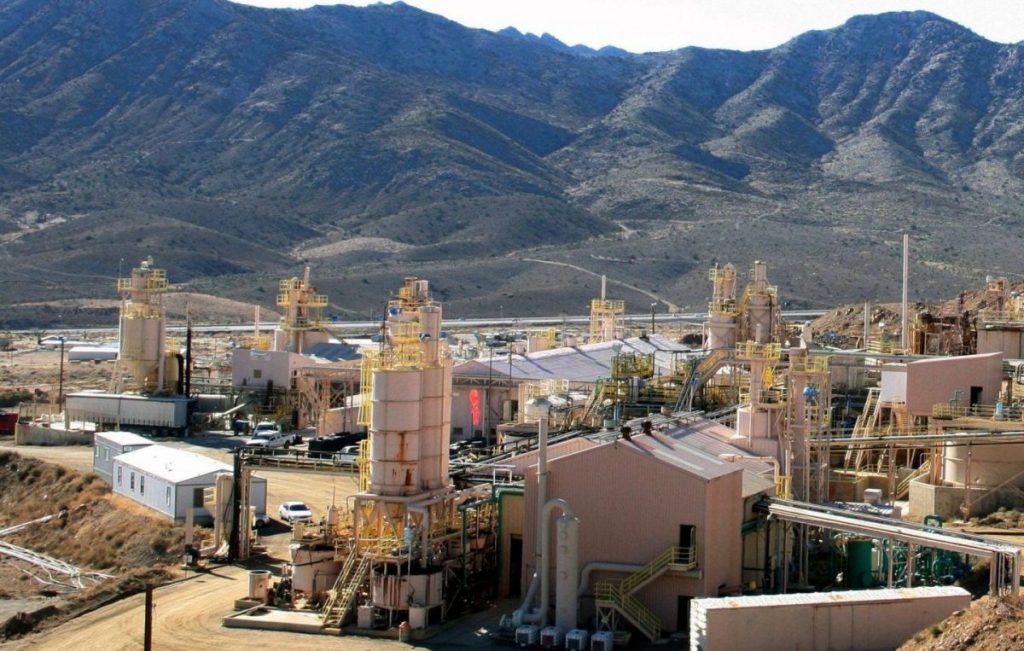

The US mining company MP Materials is playing an important role in the development of an independent value chain for rare earths. It not only operates Mountain Pass, currently the only rare earth mine in the United States, but is also building a factory where the raw materials will be processed into rare earth metals, alloys and permanent magnets for electric motors. A supply agreement is already in place with U.S. auto manufacturer General Motors. MP Materials is supported by the Department of Defense, as is the Australian mining company Lynas, which is planning two plants in Texas for the separation of heavy and light rare earths respectively. To date, there are no processing plants for the critical raw materials in the USA, so most of the processing is done in Asia.

Mountain Pass California. Photo: Imago/xBarryxSweetx

In addition to primary production, some raw material recycling projects also benefit from government subsidies. According to the US Department of Energy, the legacy of the coal industry is particularly suitable for the recovery of rare earths (we reported). The construction of a corresponding plant is to be funded with 140 million US dollars. Potential locations include the Appalachian region, North Dakota and Wyoming – regions with many abandoned mines where “secondary mining” could bring a certain upswing again. Wyoming already has a similar facility: recently, the Wyoming Innovation Center opened on a former mine site in Gillette, as Mining.com reports. There, processes are to be developed to extract rare earths from coal and its residues, but also to manufacture products such as asphalt or graphene.

The importance of a more independent supply of critical raw materials was also recently emphasized by U.S. Treasury Secretary Janet Yellen, Bloomberg writes. However, she said she was not in favor of U.S. production alone, but advocated greater cooperation with partners such as Canada: “countries that espouse a common set of values about international trade and conduct in the global economy should trade and get the benefits of trade […]”.

Read more: While the issue of raw materials supply has reached the highest level in the U.S., other countries still have some catching up to do. Germany’s raw materials policy, for example, is criticized in a recent working paper by the Federal Academy for Security Policy as no longer up to date.

Featured image: iStock/GDArts