European Commission research report sees risks in permanent magnets, batteries, fuel cells, and the underlying raw materials, among other things.

The EU is a leader in innovation in many climate-friendly technologies. However, there is a need to catch up regarding the commercialization and financing of scale-ups, i.e., companies that have already reached a certain market size and are in a phase of rapid growth. This is the result of a report by the European Commission’s Joint Research Center.

It examined 28 climate-neutral energy technologies based on ten competitive indicators such as production, turnover, imports, exports, and venture capital investments in the early and late stages. The economic union is particularly strong in the categories of high-quality patents, public research and development investments, and the number of innovative companies. The EU is far ahead in four technologies in particular: wind rotors, heat pumps, heating and cooling networks, and special ships and infrastructure for supplying offshore wind farms.

Improvements were seen in batteries, where research and development investments increased by almost 40 percent annually between 2016 and 2020. There are also signs of an upturn in the domestic production of photovoltaics, and the report confirms that the EU has an excellent industrial basis for hydrogen technologies.

Environmentally Friendly Mobility: EU Companies Could Fall Behind Further

In contrast, the authors see a “worrying trend” in transport-related technologies such as fuel cells, electric drives, charging infrastructure for electric vehicles, and alternative fuels. Less venture capital has been attracted here in a global comparison. As environmentally friendly mobility is one of the fastest growing sectors, there is a risk that innovative European companies will not find sufficient funding to bring their solutions to market.

The report continues that the domestic production of climate-neutral technologies has picked up again after the pandemic. Nevertheless, it cannot keep pace with rising demand, and an increasing proportion must be imported to meet it.

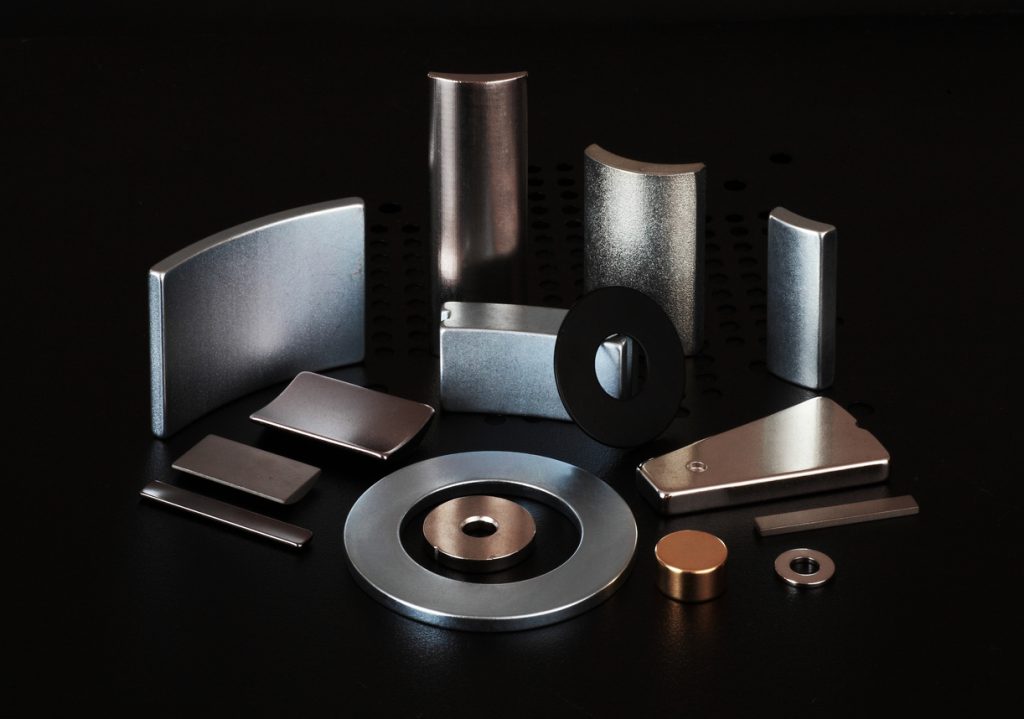

The authors see this high dependence on imports as a clear risk to the competitiveness of the European green industry. China is named the leading exporter of seven climate-friendly technologies, including photovoltaics, batteries, permanent magnets, heat pumps, and charging solutions for electric vehicles. Many of these also depend on imported raw materials, a large proportion of which come from the People’s Republic, especially rare earths. Applications for these critical minerals include permanent magnets, which in turn are important components for electric motors and wind turbines. China accounts for 60 percent of the world’s rare earth mining, 85 percent for processing, and over 90 percent for producing permanent magnets.

According to the authors, this quasi-monopoly is even more worrying given the steadily increasing demand: the EU’s market for permanent magnets is expected to triple between 2020 and 2030.

China dominates the production of rare earth magnets. Photo: iStock/xiao zhou

The People’s Republic demonstrated extraordinary market power over rare earths and numerous other raw materials this year with new export restrictions, further fueling fears of supply bottlenecks abroad.

The supply of raw materials is also a significant risk for other technologies; platinum, for example, is a critical component in fuel cells. The mines of market leader South Africa are repeatedly struggling with problems with the power supply, as well as disruptions in rail transport, while at the same time, demand for platinum is increasing, threatening shortages. The same applies to possible substitutes such as the platinum group metals palladium, ruthenium, and iridium.

EU Critical Raw Materials Act and Additional Research Intended to Provide Relief

The first planned EU law on critical minerals, which was presented in March and is now nearing the finishing line, is intended to provide incentives for greater self-sufficiency and diversification of supply. It envisages that by 2030, the European Union will extract 10 percent of its annual demand for 17 strategic raw materials, cover 25 percent through recycling, and process 40 percent itself. However, one of the challenges on this path is the long lead times for new mines. Therefore, reports of discovering new deposits, such as in Kiruna in northern Sweden, always raise hopes. Still, experience shows that it often takes decades before they can start production.

The report concludes that the EU is also focusing on research and development projects. Projects are currently underway that are primarily aimed at strengthening the circular economy and recycling, as well as innovations in rare earth magnets. The EU also supports the construction of the first European factory to produce these indispensable components in Estonia.