Limits buyers from claiming full credits when purchased cars contain battery materials from “foreign entities of concern” – China, North Korea, Russia, and Iran.

The U.S. Government under President Joe Biden continuously adjusts its tax credit policies for purchasing electric vehicles (EVs) covered by the Inflation Reduction Act. Initial drafts of the regulation required carmakers to source 40 percent of the battery raw materials from the U.S. or a country with a free trade agreement. However, this was extended to countries with which the U.S. signed agreements on critical minerals. Such an agreement was signed with Japan earlier this year and is also sought with the EU. Over the weekend, the U.S. Departments of Energy and Treasury have published adjusted proposed guidelines. Under these new criteria, EVs that contain battery minerals sourced from “foreign entities of concern” will not qualify for the full $7,500 tax credits from 2024 onwards. A foreign entity of concern is any company more than 25 percent owned by Chinese, North Korean, Iranian, or Russian shareholders. From 2025, EVs cannot contain any critical minerals used in other components besides the battery that are extracted, processed, or recycled by these countries to qualify for the entire tax credits.

Guidelines Aim to Bolster Domestic Critical Mineral Supply Chains

The Departments assert that these new guidelines aim to strengthen domestic critical mineral supply chains and boost the manufacturing industry in the U.S. by incentivizing carmakers to adjust their supply chains to provide their customers with tax credits in order to remain competitive. Currently, the U.S. imports most of its critical minerals, like rare earths, mainly from China (PDF). While the People’s Republic controls large portions of mining, the country also dominates downstream processing and refining capacities. For example, despite Australia producing roughly half of the world’s mining output of the battery material lithium, China’s share of refining lithium is between 50 and 70 percent. Because Chinese companies control portions of some players in Australia’s lithium sector, parts of the country’s lithium would be excluded from U.S. tax credits, depending on where each feedstock is refined, the Australian Financial Review reports (Paywall). Thus, the U.S. proposal could also impact foreign supply chains.

Transforming Supply Chains Takes Time

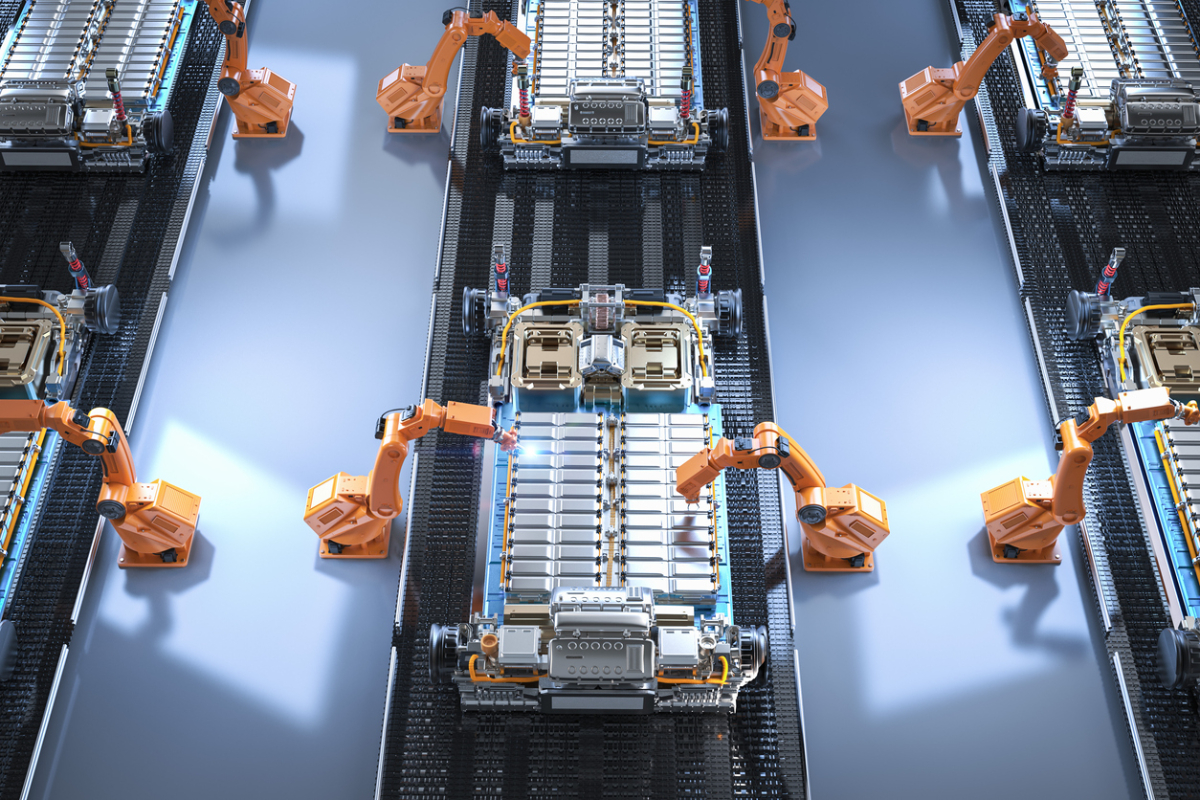

The new proposal could change American supply chains eventually, as it would spur investment into the critical mineral sector in the U.S., the Treasury added. However, constructing mining and processing facilities takes years to be operational. According to the Associated Press, analysts predict 2024 and 2025 to be challenging for EV producers in the U.S. as supply chain changes take time to come into effect. In addition to critical minerals, the final assembly of EVs is also mandated to happen in North America to qualify for the full tax credits. To comply with this rule, multiple foreign carmakers have already announced plans for building plants in the U.S. or Canada or are already constructing them, like German and South Korean carmakers BMW and Hyundai.

Photo: iStock/PhonlamaiPhoto