Regions struggling with sinking demand for coal could repurpose their mining expertise.

The demand for rare earths has climbed steadily throughout the last decades given that they are components of many electric devices but also central to the energy transition: Most wind turbines and motors of electric vehicles require high-performance permanent magnets made of an alloy of neodymium, iron, and boron. But the fields of application are not limited to clean energy and electromobility, from smartphones and smartwatches to lasers and lighting technologies, rare earth elements (REE) are a common part of everyday life.

China accounts for roughly two-thirds of the world’s mining production of rare earths, according to the U.S. Geological Survey, while the U.S. generates around 15 percent. However, the dominance of the People’s Republic becomes increasingly evident in downstream production steps where China accounts for 85 percent of rare earths processing, and 92 percent of rare earth magnet manufacturing. This chokehold on the industry forces other countries including the U.S. into a dependency on imports.

Rare Earth Elements in the U.S.

China was not always the dominating player in the rare earths industry: The U.S. once supplied most of the global REE demand in the late 20th century through the Mountain Pass mine in southern California. Increasing global competition and environmental struggles forced the mine out of business at the turn of the century. The new operator MP Materials, a Las Vegas-based rare earth elements producer, restarted operations in 2017. Currently, Mountain Pass is the only active REE mine in the U.S., accounting for the U.S.’ share of 15 percent of the global production of these critical minerals. Downstream processing still happens in China, however.

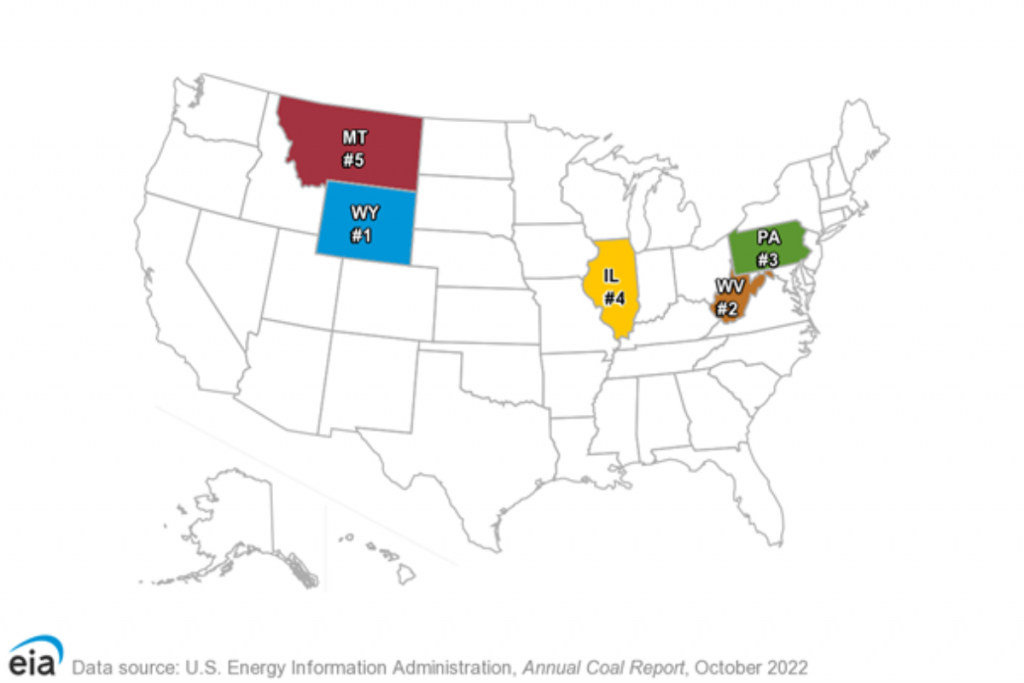

This could change in the coming decades. States with a long history of coal mining that are struggling with the sinking demand for the fossil fuel amidst the energy transformation could position themselves as REE producers. Former coal regions such as Wyoming, Utah, Montana, and Appalachian states like West Virginia and Kentucky grappled with declining coal production. In the Appalachian region, the industry lost over 37,000 jobs between 2011 and 2021, according to the Appalachian Regional Commission (PDF). Additionally, former mines are also leaving a troubling legacy behind: Acidic drainages are polluting nearby waters through their low pH value. Additionally, the erosion, shafts, vertical walls, and spoils are difficult to build upon. The U.S. Bureau of Land Management maintains an inventory of known abandoned mines on BLM-managed land. Currently, the inventory contains 57,586 sites, of which about 20 percent have been remediated or do not require further action. The remaining 80 percent require further investigation or remediation, or both.

Coal Production and its Leftovers

Wyoming, the country’s largest coal producer, accounting for roughly 40 percent of the entire U.S. coal production, just recently announced the discovery of possibly the largest rare earths deposits in North America. However, the exploration and opening of new mines do not solve the issue of what to do with the thousands of abandoned mining sites. A mining cycle typically consists of exploration, discovery, development, construction, production, and finally, closure.

Companies just now realize that abandoned and active mines still contain other valuable resources. Industry leaders like Rio Tinto are hence funding projects to extract critical minerals from mining wastewater and other residues. Besides obvious economic reasons, filtering mining tailings also presents a more environmentally friendly approach to the production leftovers. A study, published in the journal Environmental Engineering Science, supports this twofold result. The researchers assess an experimental process that successfully cleaned coal mine drainage while filtering out rare-earth elements in samples from various rivers across Ohio, Pennsylvania, and West Virginia. Repurposing active and abandoned coal mines into rare earth mines is hence also funded by the U.S. Department of Energy through the bipartisan Infrastructure Law.

Tapping Into Unused Resources

Research in this field is beginning to gain momentum. Multiple universities have initiated projects trying to venture into this rather unexplored field. A team from the Pennsylvania State University emphasizes the economic possibility and environmental benefits of exploring former mining grounds in the state that was once a major producer of coal and cobalt. Likewise a state with a long-stretching history of mining, West Virginia University researchers have recently received $8 million in funding from the U.S. Department of Energy to explore the feasibility of a large-scale version of a project extracting REEs from acidic mine drainage (AMD). The team led by Dr. Paul Ziemkiewicz, director of the Water Research Institute at the University, will build project test sites for the recovery of minerals in West Virginia and Montana. Ziemkiewicz, a forerunner in the field, has provided rawmaterials.net with the background of the project. “In 2015 our research team at West Virginia University, through research grants from the U.S. Department of Energy pioneered the idea of recovering rare earth elements during acid mine drainage treatment. Eight years later, we have a fully operating plant that treats up to 5,500 m³ per day of acid mine drainage (AMD) from a nearby coal mine. The plant has the capacity to produce over one ton of rare earth and critical materials (REE/CM) per year. We plan to replicate that patented design across both coal and metal mining sites that similarly generate acid mine drainage to produce a supply chain feeding a REE/CM concentrate to a central refinery.”

Acidic mine drainage in the Appalachians (Photo: iStock/kstevecope)

After the Shale Revolution – the Rare Earths Revolution?

America’s industry once faced a similar situation. The so-called shale revolution and the implementation of fracking made natural gas and oil economically viable and have been correlated with a rise in employment. Shale deposits were known to contain natural gas and oil since the 20th century, but the method of extracting the resources through hydraulic fracking became possible on a large scale in the early 2000s and 2010s. The oil and gas industry of the entire U.S. added 169,000 jobs between 2010 and 2012, according to the Council on Foreign Relations. Now, a rare earths revolution could give the troubled coal regions another influx of jobs and opportunities. However, the field needs more research and additional approaches besides existing projects like Ziemkiewicz’s team’s REE extraction from acidic mine drainage. Dr. Ziemkiewicz argues that “it is unlikely that REE recovery from AMD will have the same economic impact as Shale Gas, but it will diversify the product suite from mines, providing legacy jobs while offsetting the cost of treating AMD and protecting the receiving streams.” Combined with other ventures in the field, however, the impacts of establishing secondary sources of REE are not insignificant for the U.S. economy and the environment. Filtering mine tailings while extracting valuable critical minerals could combine ecological with economic benefits.

Photo: iStock/EvgenyMiroshnichenko