The Saskatchewan Research Council (SRC), operator of Canada’s first rare earth refinery, has partnered with REalloys to complete the supply chain.

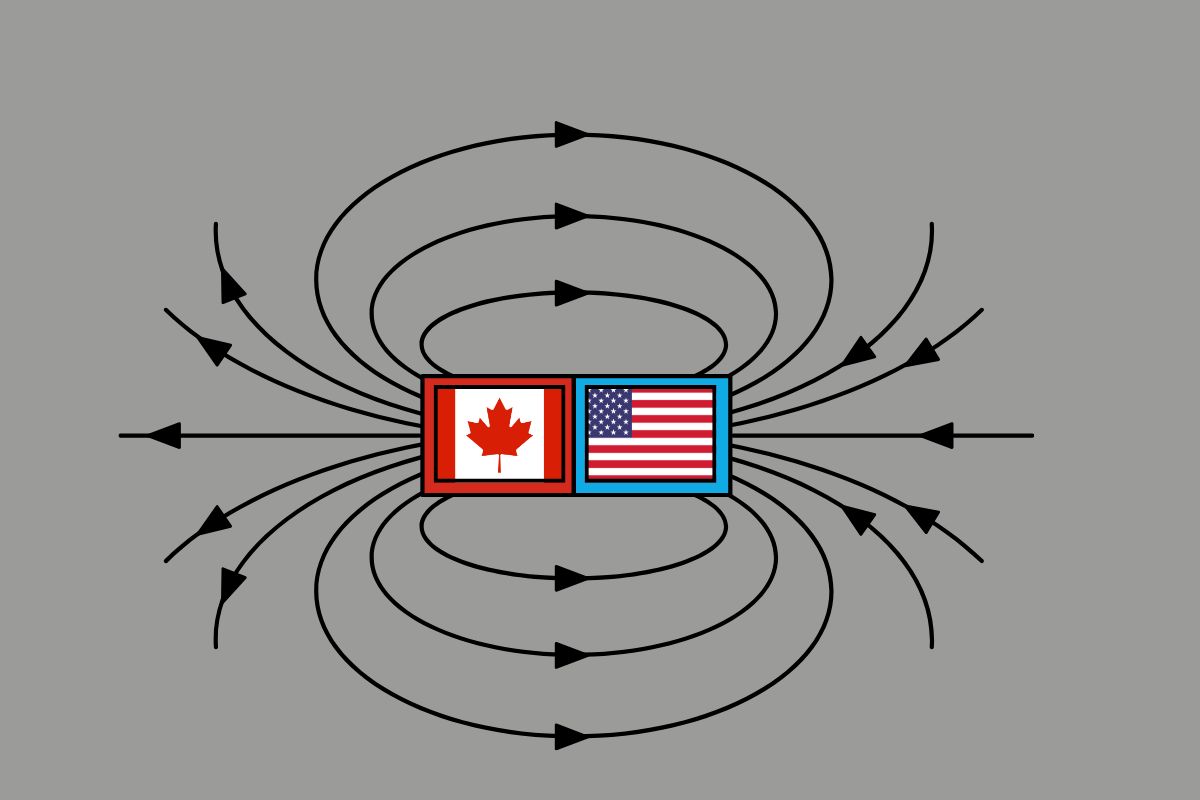

Another step toward North American resource autonomy: The Saskatchewan Research Council (SRC), which runs Canada’s first rare earth refinery, has entered into a partnership with REalloys. The U.S.-based company is building a vertically integrated rare earth supply chain, from mining to magnets. This includes developing the Hoidas Lake rare earth deposit in Saskatchewan, Canada, as well as producing rare earth metals and magnetic materials in Ohio, USA.

The collaboration with SRC could now complete the midstream portion of the supply chain: a five-year off-take agreement is planned for roughly 80% of the annual production of the Canadian processing facility in Saskatoon. In addition, REalloys plans to invest $21 million in expanding the SRC facility. Once completed, the plant could produce up to 600 tons of neodymium-praseodymium metal, 30 tons of dysprosium oxide, and 15 tons of terbium oxide annually. The two heavy rare earth elements, dysprosium and terbium, are considered particularly critical as they are essential components for high-performance permanent magnets used in defense and aerospace industries. At the same time, China, the main producer, has placed strict limits on exports.

Use of Chinese Rare Earth Magnets in U.S. Military Systems Banned from 2027

According to REalloys, the company supplies exclusively to “protected markets” in the U.S., including the defense sector and the national stockpile, where material sourcing is strictly regulated. The partnership with SRC is intended to meet these regulatory requirements. A new U.S. law stipulates that, starting in 2027, no rare earth magnets of Chinese origin may be used in domestic military systems. Instead, critical materials must come from “trusted domestic or allied producers.” Unlike the older regulations on which the new law was based, the entire supply chain is now included: mining, refining, separation, melting, and manufacturing.

The SRC facility is expected to reach full production by early 2027. It can process monazite and made headlines in September 2024 for the first commercial production of rare earth metals in North America. The strategic significance of the facility is reflected not only in financial support from the Canadian government but also in bilateral supply chain development partnerships, for example with Vietnam and France. Another Canadian rare earth refinery planned by mining company Vital Metals was put on hold in April 2023 due to economic feasibility concerns.

Meanwhile, REalloys plans to build its own, even larger facility in Saskatoon based on the new partnership, with production capacities including up to 200 tons of dysprosium metal.

Photo: via Canva, Montage Rohstoff.net