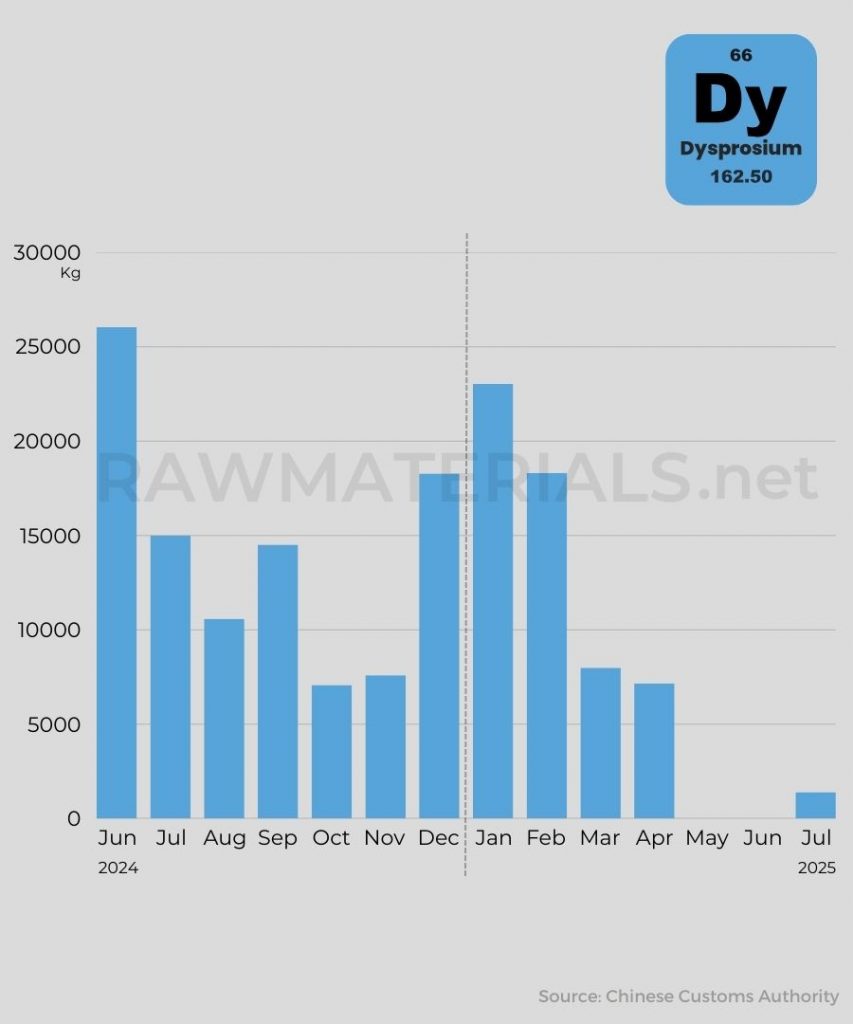

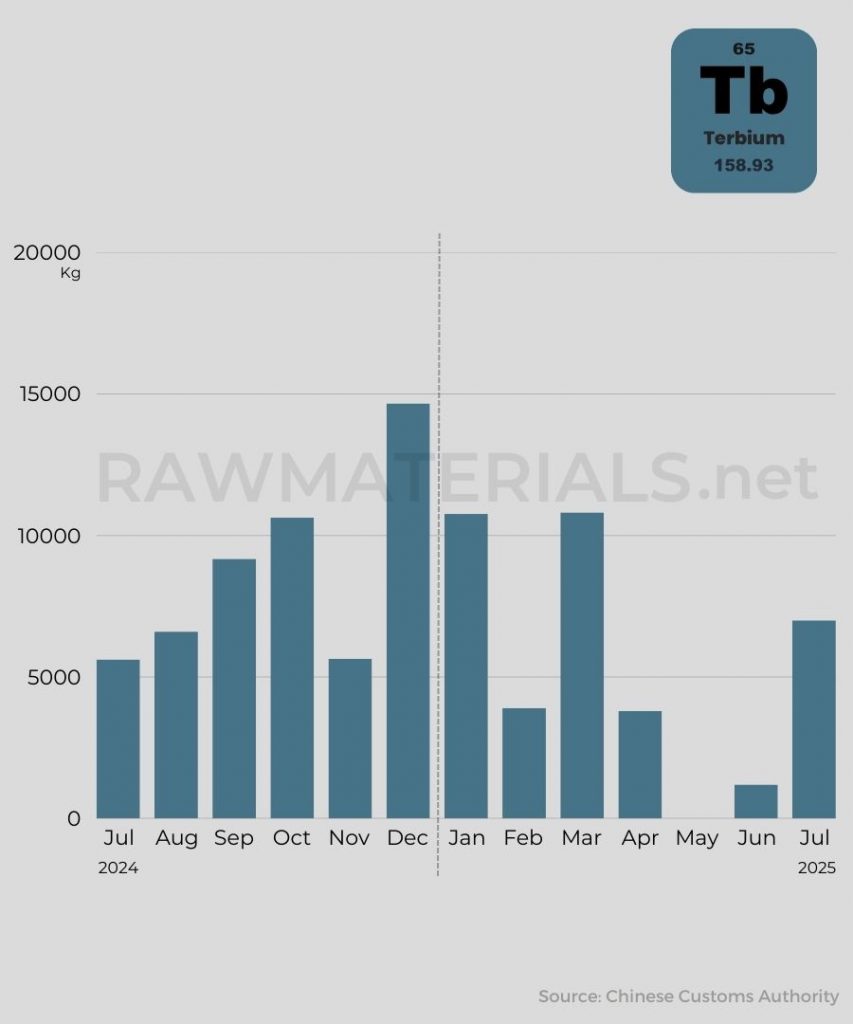

China is resuming exports of dysprosium and terbium. However, the number of destinations is dwindling. According to new data from Chinese customs authorities, the country shipped 1,400 kilograms of dysprosium and 7,000 kilograms of terbium in July. All dysprosium exports went to South Korea, while terbium was split almost equally between South Korea and Japan. In comparison, in the same period last year, China exported terbium to a total of nine countries.

Dysprosium exports from China over the last year.

Terbium exports from China over the last year.

In June, exports were minimal, with only 1 kilogram of dysprosium and 1,200 kilograms of terbium leaving China. This is due to the export licensing system that has been in place since April for both metals. Despite the recent recovery, current levels remain well below those of the previous year. The trend mirrors that seen with other technology metals such as gallium and germanium. Since summer 2023, export restrictions on these metals have caused shipments to initially grind to a halt, with a slow recovery afterward—but volumes remain very low. The number of trade partners has also decreased.

Dysprosium and terbium are key raw materials for a wide range of high-tech applications, from semiconductor manufacturing to the chemical industry. Their most important use, however, is in neodymium-iron-boron (NdFeB) magnets.

Photo: Polina Tankilevitch via Canva