Key signal for platinum group metals.

As part of the automotive policy package presented on Tuesday, the European Union is easing the planned ban on the sale of internal combustion engine (ICE) vehicles scheduled for 2035. While the overarching target of a 100 percent reduction in emissions formally remains in place, this reduction would no longer need to be achieved exclusively during vehicle operation. Instead, CO₂ emissions generated after 2035 could be offset through alternative mechanisms.

In practical terms, this means manufacturers may improve their emissions balance by using sustainably produced steel or alternative fuels, including e-fuels. Effectively, the regulation would require a 90 percent reduction in emissions, while still allowing the continued sale of conventional vehicles, as well as plug-in hybrids and range extenders.

According to the European Commission, the package continues to send a “strong market signal for zero-emission vehicles,” while also granting the automotive industry greater flexibility in meeting CO₂ targets. The proposals also include measures to strengthen Europe’s domestic battery value chain, reduce bureaucracy, and promote the production of smaller, more affordable electric vehicles.

As with all EU legislative initiatives, the proposals must still be approved by both the Council and the European Parliament.

The potential end of the ICE phase-out has been debated repeatedly in recent years. Most recently, a similar initiative emerged in March as part of an action plan to improve the competitiveness of Europe’s automotive industry. Even before the official announcement, economists had criticized the decision. Sebastian Dullien, Director of the Institute for Macroeconomics and Business Cycle Research (IMK), argued that the core challenge facing German automakers is not the combustion engine ban itself, but rather their technological lag—particularly in battery cell development.

Beyond the automotive sector, the EU’s decision also represents a significant market signal for platinum group metals, given that the automotive industry, especially catalytic converters, is the dominant end-use sector for palladium (accounting for 70–85 percent of demand) and rhodium (55–80 percent). Platinum, which is also heavily used in catalytic converters (approximately 30–45 percent of total demand), is expected to benefit as well.

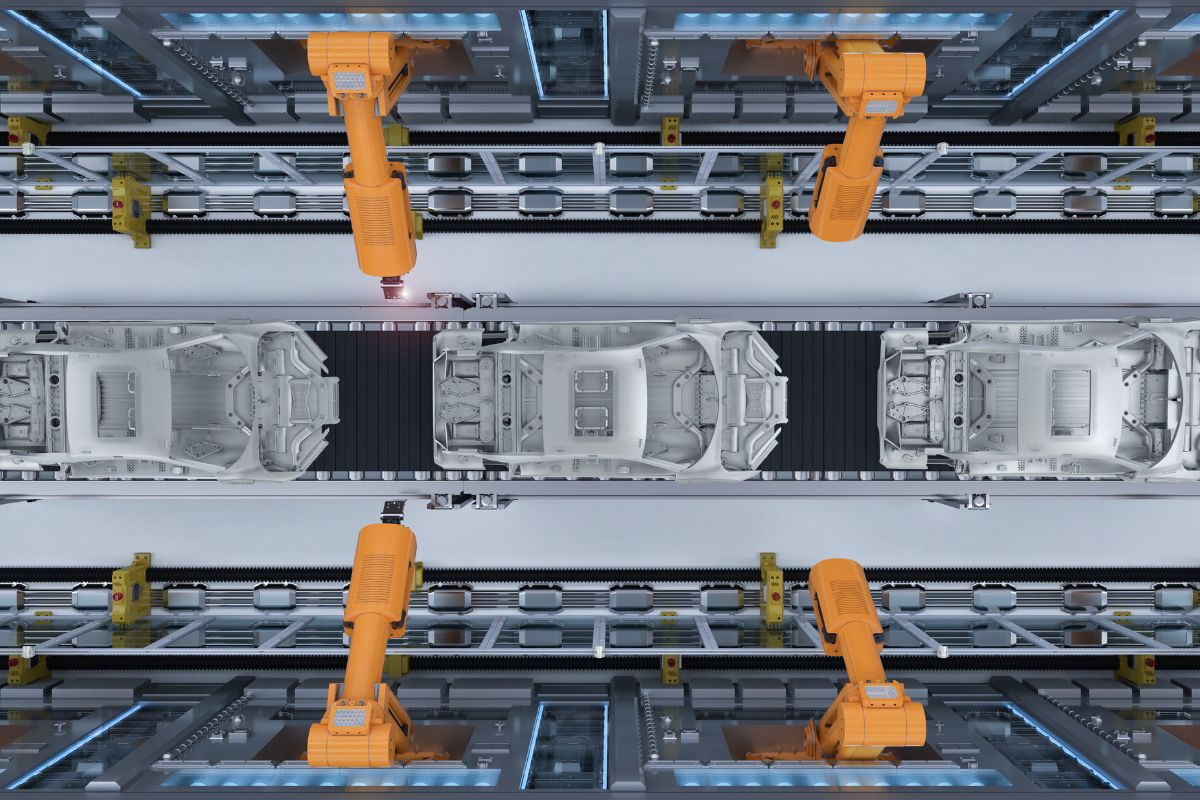

Photo: PhonlamaiPhoto